Tax relief refers to a reduction in the amount of tax an individual or company has to pay. Increased from RM3000 to RM4000.

Doing Business In The United States Federal Tax Issues Pwc

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

. Increase in Deduction for SpousePayment of Alimony to former Wife. PwC 20162017 Malaysian Tax Booklet INCOME TAX Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of airsea transport banking or insurance which is assessable on a world income scope. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020.

Non-resident individuals income tax rate increased by 3. Increased from RM1000 to RM2000. Bantuan Rakyat 1Malaysia BR1M subsidies.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. It also included increases in the child tax credit. EGTRRA included a new 10-percent tax rate bracket as well as reductions in tax rates for brackets higher than 15 percent of one-half percentage point for 2001 and 1 percentage point for 2002.

On the First 2500. Tax relief for individual taxpayer whose spouse has no income is increased from RM3000 to RM4000. Income Tax for Non-Resident Individual.

No other taxes are imposed on income from petroleum operations. Amending the Income Tax Return Form. The 2016 Budget representing the first step of the 11th and final Malaysia Plan towards.

On the First 35000 Next 15000. Return to the homepage. The higher income classes in Malaysia on the other hand will experience an increase in the rate of income tax by 1 to 3 for individuals with chargeable income exceeding RM600000.

On the First 5000 Next 5000. 13 rows 2000000. Increase in Deduction for Child.

On the First 5000. Leasing income from moveable property derived by a permanent establishment in Malaysia is taxed against a rate of 25 whereas a non-resident corporation with no Malaysian permanent establishment is taxed against a rate of 10. Other income is taxed at a rate of 30 17 hence your net pay will only increase by 45 This calculator helps you to calculate the tax you owe on your taxable income for the full income year Monthly Salary x Number of Days employed in the month Number of days in the respective month Example.

Change In Accounting Period. Tax Rate of Company. 25 percent 24 percent from Year of Assessment YA 2016 Special tax rates apply for companies resident in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of the basis period for a year of assessment provided not more than 50 percent of the ordinary paid-.

The amount of tax relief 2016 is determined according to governments graduated scale. On the First 10000. For chargeable income in excess of MYR 500000 the corporate income tax rate is 25.

Income attributable to a Labuan. Introduction Individual Income Tax. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

On the First 20000 Next 15000. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. On the First 35000.

There are no other local state or provincial government taxes. Income from RM2000001. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.

Individual Income Tax Returns 2016 Individual Income Tax Rates 2016 28 Act of 2003 JGTRRA. Malaysia Personal Income Tax Rate. Tax relief for each child below 18 years of age is increased from RM1000 to RM2000 from year of assessment 2016.

Malaysia Residents Income Tax Tables in 2022. From 25 to 28. Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the purpose to reduced the burden of tax payers.

Income from RM5000001. Chargeable Income Calculations RM Rate TaxRM 0 2500. Malaysia Tax Guide For Expatriate Under Malaysia My Second Home Program MM2H However at the end of each year you need to file a tax return belastingaangifte and declare your income and assets Salaries Calculation Calculate your monthly payscale An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal.

Maximum rate at 25 will be increased to 26 and 28. Were sorry something went wrong. The fixed income tax rate for non-resident individuals be increased by 3 from 25 to 28 from YA 2016.

Chargeable income RM Calculations RM Tax Rate Tax Amount RM 0-2500. On the First 10000 Next 10000. On the First 2500.

Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. Income from RM500001. Income from RM3500001.

On the First 20000. Employee Starts work on 12 Withholding tax Withholding tax.

Individual Income Tax In Malaysia For Expatriates

How To Calculate Income Tax In Excel

World S Highest Effective Personal Tax Rates

Income Tax Definition And Examples Market Business News

How To Calculate Income Tax In Excel

Irs Announces 2016 Tax Rates Standard Deductions Exemption Amounts And More

Poland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Thailand S New Personal Income Tax Structure Comes Into Effect Asean Business News

How To Calculate Income Tax In Excel

Flowchart Final Income Tax Download Scientific Diagram

How To Calculate Income Tax In Excel

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

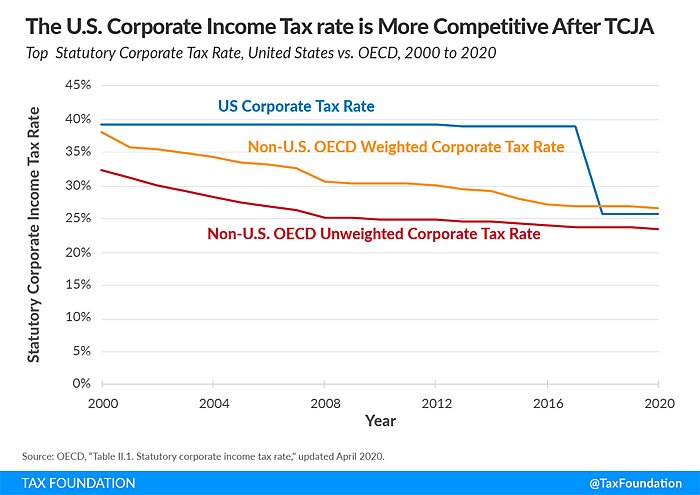

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute

Asiapedia Singapore S Corporate Income Tax Quick Facts Dezan Shira Associates

How To Calculate Income Tax In Excel

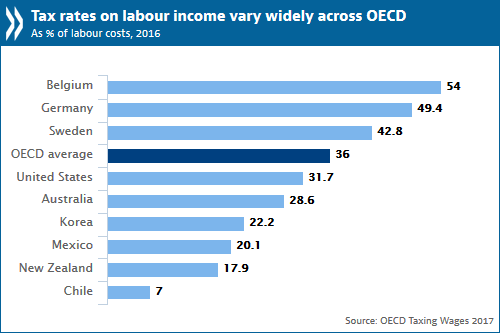

Oecd Tax Rates On Labour Income Continued Decreasing Slowly In 2016 Oecd

Corporate Income Tax And Effective Tax Rate Download Table

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)